Understanding the Need

Choosing the right business structure is a crucial decision for any new entrepreneur. It impacts liability, taxation, administrative requirements, and even the perceived credibility of your business. Two common structures for small businesses are Limited Liability Companies (LLCs) and Doing Business As (DBAs). Understanding the key differences is essential for making an informed decision that aligns with your business needs and goals. For example, a plumbing company that operates on client property and carries inherent risks would have different structural needs than a home-based sewing business.

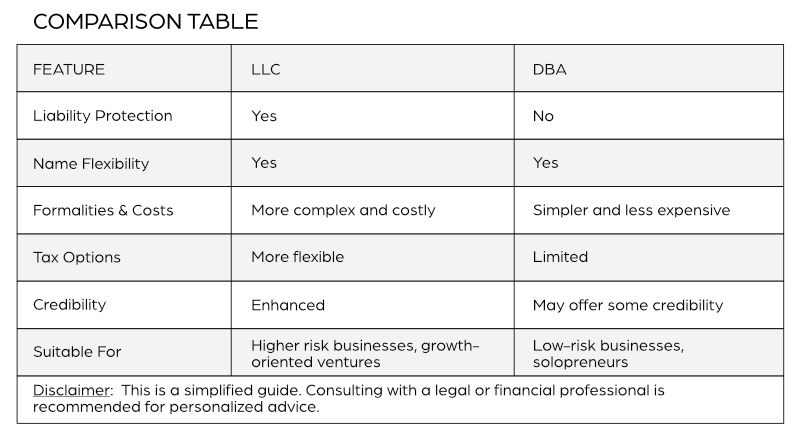

Let’s delve into the specifics of each structure, with further detail of each below:

- LLC (Limited Liability Company): An LLC provides limited liability protection, separating personal assets from business debts and liabilities. This is crucial for businesses with higher risks, such as those involving physical products, potential lawsuits, or significant financial investments. Examples include construction companies, consulting firms, restaurants, etc.

- DBA (Doing Business As): A DBA allows you to operate your business under a name different from your personal name or the registered name of your business entity (if it’s a sole proprietorship or partnership). It doesn’t offer liability protection. This is suitable for low-risk businesses or solopreneurs just starting, such as freelance writers, graphic designers, online sellers with limited inventory, etc.

Factors to Consider:

- Level of Risk: Assess the potential risks involved in your business operations. Higher-risk businesses generally benefit from the liability protection of an LLC.

- Tax Implications: LLCs offer flexibility in tax structures, allowing you to choose how you want to be taxed. DBAs, on the other hand, are typically taxed as sole proprietorships or partnerships.

- Administrative Requirements: LLCs involve more paperwork and formalities compared to DBAs, including filing articles of organization with the state and maintaining an operating agreement.

- Cost Considerations: LLC formation and maintenance typically involve higher costs due to state filing fees and ongoing compliance requirements.

- Business Image and Credibility: An LLC can enhance your business’s professional image and credibility, especially when dealing with customers, partners, or investors.

Forming an LLC: Navigating the Process with Confidence

So you’ve got a fantastic idea for a small business, and you’re ready to take the leap into the world of entrepreneurship – that’s awesome! But when it comes to the legal stuff, like forming an LLC, things can get a bit confusing. Don’t worry, we’ll break it down into simple steps and show you how to do it yourself without breaking the bank.

Why an LLC?

First things first, why choose an LLC? An LLC, or Limited Liability Company, is a popular choice for small businesses because it offers a couple of big advantages:

- Protection for Your Personal Stuff: An LLC separates your personal assets (like your house and car) from your business debts and liabilities. This means if your business runs into trouble, your personal belongings are generally safe.

- Flexibility and Simplicity: LLCs are pretty flexible when it comes to taxes and management, and they’re generally easier to set up and maintain compared to other business structures like corporations.

Forming Your LLC: A Step-by-Step Guide

Now, let’s get down to business and walk through the steps of forming your LLC:

- Pick Your Home Base: Decide which state you want to register your LLC in. This is usually the state where your business will be located or where you’ll do most of your business activities.

- Name Your Business: Choose a catchy and memorable name for your LLC, but make sure it’s not already taken by another business in your state. You can usually do a quick name search on your state’s official website for business filings. Have a few backup names just in case your first choice is unavailable. In Texas, the Office of the Secretary of State provides an online portal to both search for names, and file for your LLC.

- Registered Agent: Every LLC needs a registered agent. This is simply a person or company who agrees to receive official mail and legal documents on behalf of your business. You can be your own registered agent, or you can use a registered agent service. When you select your Registered Agent, the state requires them to provide written consent.

- Paperwork Time: To officially form your LLC, you’ll need to file some paperwork with your state, usually called “Articles of Organization.” This document basically tells the state who you are, what your business does, and who your registered agent is. In Texas, the filing fee is $300.

- Operating Agreement (Optional, but Recommended): Think of an operating agreement like a rulebook for your business. It outlines things like who owns what, how decisions are made, and how profits are shared. It’s especially important if you have multiple people involved in your business.

- Get Your EIN: An EIN, or Employer Identification Number, is like a Social Security number for your business and is a federal requirement. You’ll need it for things like opening a business bank account and filing taxes. You can get one for free from the IRS website.

Doing It Yourself vs. Hiring Help

Now, you might be wondering if you need to hire a lawyer or one of those online LLC formation services to help you with all this. While there’s nothing wrong with seeking professional guidance, especially if your business situation is complex, many small businesses can absolutely handle forming an LLC on their own. It just takes a bit of research and time.

Be Cautious of Online Services: Be wary of those online services that advertise super low fees to form your LLC. They often tack on hidden charges and upsells, which can end up costing you a lot more in the long run.

Consider a Local Attorney: If you do want some help, consider talking to a local small business attorney. They can provide personalized advice and ensure you’re doing everything correctly.

You’ve Got This!

Starting a small business is a big step, but it doesn’t have to be overwhelming. By understanding the basics of LLC formation and taking things one step at a time, you can get your business up and running without unnecessary costs or complications. So go out there and make your entrepreneurial dreams a reality!

Doing Business As (DBA): A Simple Way to Name Your Business

So, you’re starting a small business, and you want to operate under a name that’s different from your personal name – maybe something catchy and memorable that reflects your brand. That’s where a DBA, or “Doing Business As,” comes in. It’s a simple and affordable way to give your business a unique identity without the complexities of forming a formal business structure like an LLC.

DBA Basics

A DBA is basically a fictitious business name – it’s like a nickname for your business. It allows you to:

- Operate under a different name: Instead of using your personal name, you can use your DBA for business activities like marketing, signing contracts, and opening a business bank account.

- Build brand recognition: A DBA helps you create a distinct identity for your business, making it easier for customers to remember and recognize you.

Is a DBA Right for You?

DBAs are a great option for:

- Sole proprietors: If you’re the only owner of your business, a DBA is a simple way to give your business a professional name without the formalities of forming an LLC or corporation.

- Low-risk businesses: If your business activities carry minimal risk of lawsuits or financial liabilities, a DBA might be all you need.

- Testing the waters: If you’re just starting out and not sure if your business idea will take off, a DBA can be a cost-effective way to test the market before committing to a more complex business structure.

Keep in Mind:

- No Liability Protection: Unlike an LLC, a DBA does not offer any personal liability protection. This means your personal assets are still at risk if your business faces debts or lawsuits.

- Name Availability: You’ll need to make sure your chosen DBA name is available in your state and doesn’t infringe on any existing trademarks.

Getting Your DBA: A Simple Process

- Check Name Availability: Search your state’s business name database or county clerk’s office to ensure your desired DBA name is available. The Texas Secretary of State has a handy portal to search for business names. The fee is $1 per name search.

- File the Paperwork: You’ll typically need to file a DBA application with your local or state government. This usually involves filling out a simple form and paying a small filing fee. There are other considerations for actually opening the business. See Part 1 of this series or download our handy checklist.

- Publish a Notice (Depending on Your State): Some states require you to publish a notice of your DBA in a local newspaper for a certain period of time. This is not a requirement in Texas.

That’s it! Getting a DBA is a straightforward process, and you can often do it yourself without needing to hire a lawyer.

DBA vs. LLC: Making the Right Choice

Choosing between a DBA and an LLC depends on your specific business needs and risk tolerance. If you’re looking for a simple and affordable way to name your business and don’t need the liability protection of an LLC, a DBA is a great option. However, if your business carries higher risks or you want to ensure your personal assets are protected, forming an LLC might be the better choice.

Remember, there’s no one-size-fits-all answer, so consider your individual circumstances and seek professional advice if needed.